As the calendar flips into the new year, 401(k) compliance teams across the country are prepared for long days as they race against a March 15 deadline to complete the required Nondiscrimination Tests. These tests are required by the IRS to ensure that every employee can benefit from the plan. That is the tradeoff for the special tax status that 401(k) plans enjoy.

To avoid additional penalties and ensure testing is completed by March 15, American Trust Retirement requests that plan sponsors submit the annual census and questionnaire by January 31.

What are 401(k) Nondiscrimination Tests?

Nondiscrimination tests are annual tests required to ensure that 401(k) retirement plans benefit all the employees, (not just business owners or highly paid employees). These tests separate eligible employees into two groups: owners and highly compensated employees (HCEs) against everyone else.

More specifically, these tests first separate employees into a few groups:

- Highly Compensated Employees (HCEs)

- Key Employees

- Non-Highly Compensated Employees (NHCEs)

- Non-Key Employees

The nondiscrimination tests then assess various factors:

- The percentage of income employees defer.

- The company’s contributions to employee accounts.

- The share of total plan assets belonging to HCEs and Key Employees

These tests confirm that deferred wages and employer matching contributions do not discriminate in favor of highly compensated employees.

Businesses offering a 401(k) plan must pass two primary nondiscrimination tests annually:

- The Actual Deferral Percentage Test (ADP)

- The Actual Contribution Percentage Test (ACP)

In addition, most plans need to pass a third compliance test annually, known as the Top Heavy Test, which looks at the percentage of assets owned by Key Employees.

Highly Compensated vs. Non-Highly Compensated Employees

A highly compensated employee is more or less what it sounds like, although the IRS has requirements that must be met in order to qualify as one (for the purposes of your 401(k) retirement plan).

Nondiscrimination testing requirements for HCEs are as follows:

- Must own more than 5% of the interest in the business at any time during the year or preceding year, regardless of how much compensation (wages, salaries, bonuses, tips, or fringe benefits) they received

- Certain family members of 5% owners (parents, children and spouses)

- Had made more than $160,000 in 2025

Employees who do not meet the above HCE requirements are considered non-highly compensated employees. There are a few exceptions such as newly hired employees who would qualify as HCE but have not been with the company long enough to be paid the full $160,000.

ADP Test

The actual deferral percentage test or ADP test is our first nondiscrimination test. This test compares average NHCE salary deferral percentages to the average for the HCEs, and naturally involves the calculation of these numbers.

Follow the instructions below to calculate these two percentages:

Step #1: Calculate Annual HCE Deferral Rate

Gather your HCE contribution rates and average them. Display as a percentage.

ADP for HCEs = Salary Deferral / Total Compensation

Step #2: Calculate Annual NHCE Deferral Rate

Gather your NHCE contribution rates and average them, then display themas a percentage.

ADP for NHCEs = Salary Deferral / Total Compensation

Step #3: Compare and Make Your Determination

Compare the percentages and be sure that they fall within the acceptable ranges.

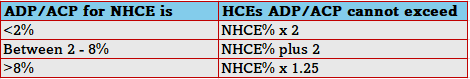

The annual maximum HCE deferral rate is based on the contribution rates of your NHCEs. Here’s how to determine the maximum HCE rates:

For example, if:

- NHCEs save 1% on average, then HCEs save more than 2%, on average.

- NHCEs save 7% then HCEs can’t save more than 9%, on average.

- If NHCEs save 12% then HCEs can’t save more than 15%, on average.

ACP Test

The Actual Contribution Percentage test is the ADP test’s cousin, which includes employer match contributions, and any after-tax contributions employees make. To that end, you follow the same basic procedure:

Step #1: Calculate Annual HCE Contribution Rate

Gather your HCE matching or after-tax contribution rates and average them. Display as a percentage.

HCE ACP = (Salary Deferrals + Employer Contributions + After Tax Contributions) / Total Compensation

Step #2: Calculate Annual NHCE Contribution Rate

Gather your NHCE matching or after-tax contribution rates and average them. Display as a percentage.

NHCE ACP = (Salary Deferrals + Employer Contributions + After Tax Contributions) / Total Compensation

Step #3: Compare and Make Your Determination

Compare the percentages and be sure that they fall within the acceptable ranges for the ADP test.

Top Heavy Test

This is the simplest of the 3 tests. Instead of comparing HCE’s vs NHCE’s, however, we have a new term that we need to discuss, Key Employee. A key employee is either an officer who makes over $230,000 a year, an owner less than 1% that earns over $150,000 or an owner more than 5%.

If the sum of all key employee account balances is greater than 60% of the total retirement account balance, the plan is top-heavy.

To find if your plan is top heavy:

Step #1: Gather Key Employee Account Balances

Total the account balances of the key employee participants in your plan as of the end of the plan year.

Step #2: Determine the Percentage of Account Balance Contributed by Key Employees

Divide the total key employee account balance by the total account plan balance and express this number as a percentage.

Step #3: Check the Result

If the result of the above calculation is greater than 60%, the plan is top-heavy, and steps must be taken.

Failed Testing? What to do next

If your plan fails nondiscrimination testing, you must take corrective action. Luckily, there are several options for doing this. These include:

- Making Corrective Distributions: Corrective Distributions involve refunding contributions made by Highly Compensated Employees (HCEs) to ensure the plan meets testing requirements. Refunds are processed in the order of each HCE’s deferral amounts. Since 2008, these refunds have been taxable in the year they are issued.

- Making QNECs: Make a Qualified Non-Elective Contribution (QNEC), an employer contribution made on behalf of all eligible employees, regardless of their individual contributions to the retirement plan.

- Making QMACs: Make a Qualified Matching Contribution (QMAC), an employer contribution made to employees based on the percentage of their salary they deferred into the retirement plan.

Those last two options are less popular, as they tend to be more expensive and less convenient.

How to avoid future testing failures

Two primary strategies could help a plan to pass the nondiscrimination test in the future.

Higher participation rates: The easiest way to bolster participation rates is to implement an auto-enrollment plan. Auto-enrollment has been such as success in encouraging participation, that the passage of the SECURE Act requires all new 401(k) plans effective 1/1/2025 to have this feature. Enhanced retirement readiness education by a financial advisor and other tools are important as well.

Adopt a Safe Harbor plan: Adopting a Safe Harbor plan allows you to bypass the ADP and ACP tests entirely. The requirement to do this, however, is a required employer contribution. There are 3 primary Safe Harbor options:

- Safe Harbor Match: The minimum employer contribution is 4% but could be up to 6% if the plan sponsor chooses. Employees have to contribute to earn the match. Has to be 100% vested immediately.

- Safe Harbor Non-Elective: This is an employer contribution to all eligible employees of 3% of salary regardless of whether the employee contributes or not. This option has the benefit of automatically passing top-heavy testing as well. Has to be 100% vested immediately.

- QACA auto enrollment: The most popular now with auto enrollment being preferred (required for new plans), the minimum employer contribution is 3.5% if an employee contributes 6% or more of their salary. Can implement a 2-year Cliff vesting schedule.

A 401(k) plan that regularly fails non-discrimination testing can cause headaches for both plan sponsors and employees. It is crucial of a plan’s health to stay ahead of these issues. If you have questions, we are here to help!